Because the label ways, there is certainly also a federal government ensure attached to the USDA mortgage. However, that have an agricultural field doesn’t have anything to do with your capability to profit from the deal.

In the event the attention from residence is so much more broad-discover room much less metropolitan townhome, a no downpayment USDA loan might possibly be a fit for your.

What is a good USDA mortgage?

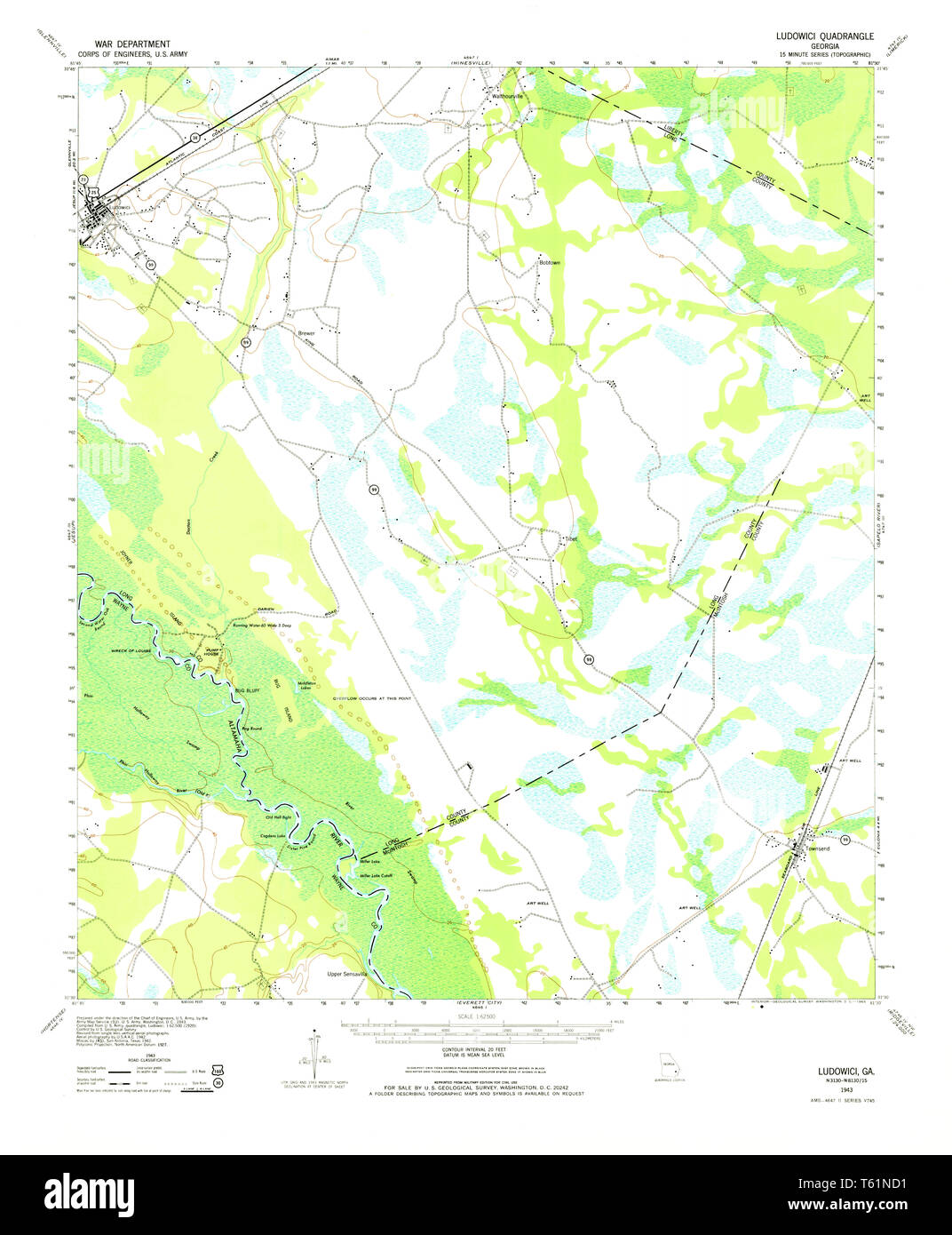

The usa Department out of Farming (USDA) mortgage (referred to as the USDA Outlying Homes Invention Protected Homes Program) is an authorities-provided a hundred% financial support program built to boost the economy and you will total well being from inside the rural elements.

By making affordable, low-appeal home loans offered to individuals who you are going to otherwise have a problem with the newest down-payment and borrowing conditions from conventional financing applications, household outside larger locations is qualify for that loan and you can very own the piece of the latest Western dream.

Exactly how USDA funds functions?

Identical to other authorities-backed funds, USDA will not give currency to the new debtor. Continue reading “Criteria in order to be eligible for an excellent USDA loan”