- Understand what You would like

Pre-acceptance are a procedure that lets your lender in order to veterinarian their economic pointers and give you a good pre-recognized mortgage matter which you can use to support your home lookup

Before you start handling a local real estate professional to locate your earliest household, it is helpful to determine just what you are searching for. Which have a listing of wished household has actually, appropriate towns, and you may financial direction to check out in family-to purchase techniques can help you slim your quest and transfer to your dream domestic faster.

Together with rate, check out the following the factors to help you restrict what you want on the earliest house:

Submit an application for pre-acceptance after you have selected a lending company so you’re able to speed up our home-buying techniques

- Size

How big household how would you like? If you intend on doing or expanding your family, it is possible to find belongings that allow the place required for high school students. Consider the cost of maintenance off a big home instead of a good house with more reasonable square video footage and you will whether or not your nearest and dearest need to have the more room or if or not excess space can get become a publicity.

Make an application for pre-acceptance once you’ve decided on a home loan company in order to automate your house-to acquire techniques

- Venue

Consider in which you want to alive. The downtown area Charleston can offer your an enchanting, progressive experience if you enjoy bustling city existence. But not, if you want characteristics and you will entertainment, you may choose to search characteristics-conscious Kiawah Island a property posts instead.

Get pre-approval once you’ve decided on a mortgage lender to help you automate the home-to get procedure

- Have

Create a list of provides that you would like your first family to possess, and determine which ones features try non-negotiable loans Auburn AL. Do you have to features a-two-automobile garage? A fenced-within the yard? A couple of complete bathrooms? Know what kind of keeps youre happy to compromise into and you will you definitely do not real time in place of to aid your pursuit.

- Store Mortgage lenders

While prepared to begin certainly looking very first household, take some time to buy available for a knowledgeable mortgage lender. Essentially, we need to get a hold of a lender that gives you a fair rate on your home loan and has now a reliable profile.

Since you lookup lending organizations, think all types of loan providers. You can test conventional finance companies, borrowing from the bank unions, otherwise on the web lenders devoted to mortgage loans. After you’ve paid on several options, see specifics on the home loan strategies.

Keep in touch with a representative to determine how long the application processes can take, exactly how your own words is actually decided, and you may if they be involved in first-time domestic buyer programs. Up coming, evaluate their interest price offers, costs, and you may downpayment criteria to help make the best bet to suit your problem.

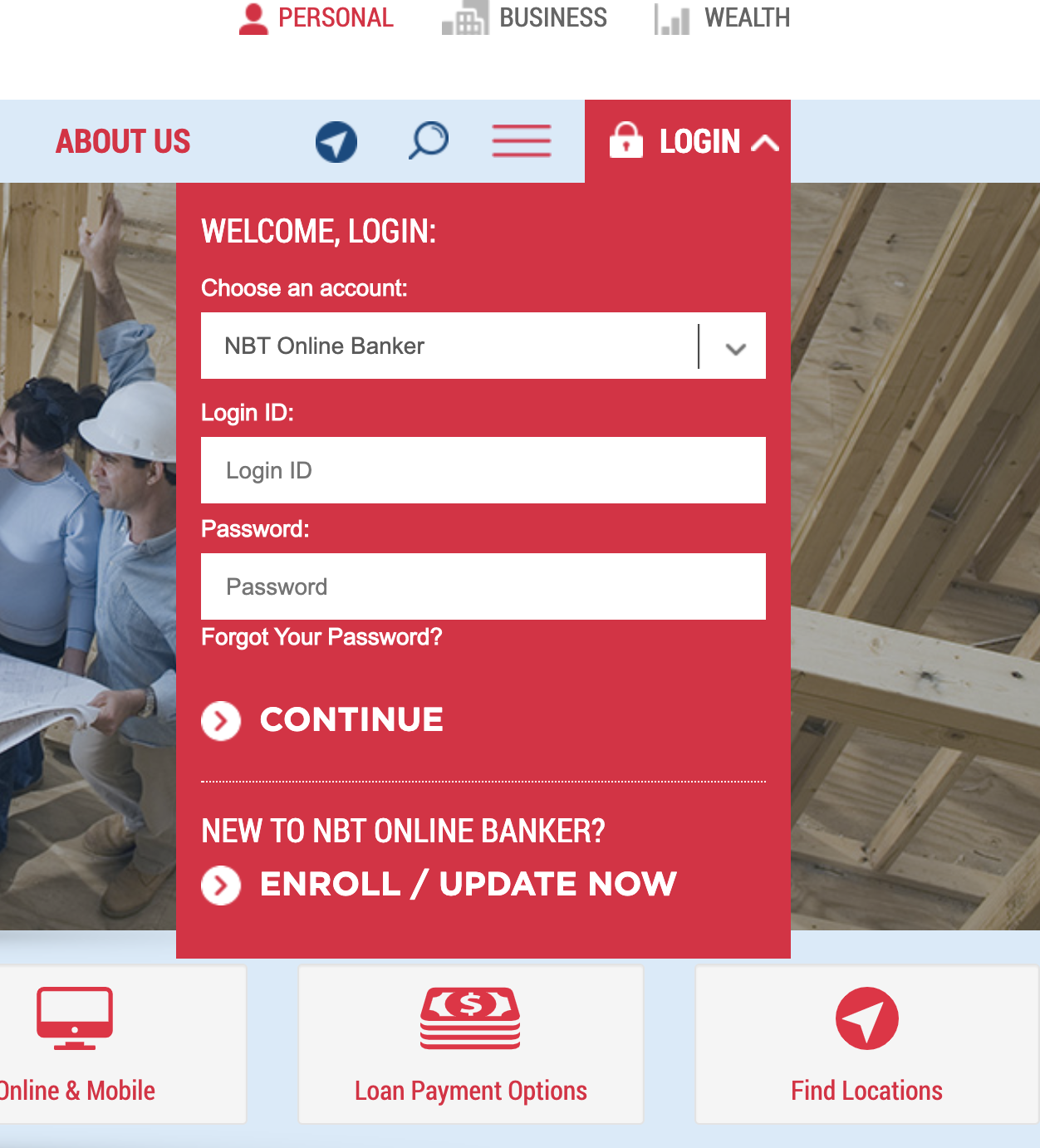

- Apply for Pre-Acceptance

Pre-recognition not just will give you a higher limit on domestic spending budget you really can afford, but it addittionally gives you a plus which have manufacturers once you discover home you desire. If you learn your ideal home and want to flow timely, you are able to an offer and give their pre-recognition to the seller.

This shows all of them your money come into buy and also you currently have financial support into purchase. This may tip a merchant in your favor and help your winnings the first house over most other bidders.

- Work at a city Agent

Handling a region real estate professional can notably change your assets-to order feel given that an initial-time house buyer. Real estate agents you to definitely understand the local business is describe their home look and help you can see the best assets that fits all your requires and you will financial price products.