To invest in a home would be rather fascinating and rather confusing – the at the same time. And it also does not matter if you are a first time domestic consumer or if perhaps this is your 2nd otherwise 3rd go out you are taking this new dive on homeownership. That’s because the entire process of making an application for a home loan, offering the supporting records and you can waiting around for a thumbs up regarding a home loan business enjoys generally speaking come one that is a long time and you may troublesome.

Brand new area of the process that are really unsure to many individuals – this new stuff that continues on behind new curtain, as they say – is the underwriting process. That’s because the common home loan applicant doesn’t know or learn just what underwriter wants since they are domestic.

What is actually home loan underwriting?

Underwriting happens when a member of the loan people – the underwriter – assesses your own financial guidance to check when it satisfies the borrowed funds lender’s standards and you will fits the requirements of the fresh new types of financing you will be trying to get. Particularly, you might be asked available:

- W-2s

- Tax statements

- Latest pay stubs

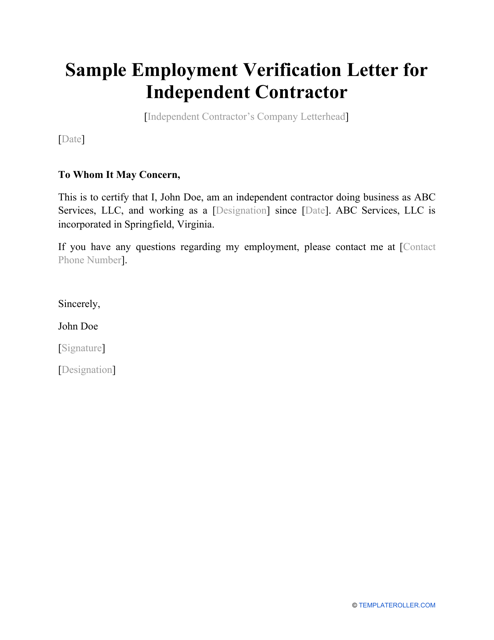

- Confirmation from a job

- Copy from bodies-given ID

- Consent to pull borrowing from the bank

Just after reviewing such documents, the newest underwriter decides exactly how high-risk it is to loan the money you need. In fact, it is an informed suppose predicated on your credit report, their property as well as your income away from exactly how probably youre to generate mortgage payments punctually and in the end pay back the loan for the complete.

Unfortuitously, of many home loan businesses manage the new underwriting procedure after you’ve already discovered the house we want to get, keeps installed a bid following apply for home financing. By firmly taking too-long to offer the necessary suggestions, or if perhaps the brand new underwriter takes too much time to make a visit on the creditworthiness, you could lose out on your ideal household.

Movement Mortgage really does one thing a bit differently. I underwrite all the loan at the beginning of the loan techniques. Thus giving your a significant advantage during the a packed sector just like the providers are more inclined to take on a quote that’s currently underwritten and pre-approved by a mortgage lender. It’s a lot more of a sure point. Very early underwriting also helps stop one last-moment race. Our very own reverse approach is unique – we assess the mortgage and you will try to get it released of underwriting inside six hours* – letting you bypass a market laden up with exhausting and you may slow loan providers.

But what, precisely, ‘s the underwriter creating when they choose whether or not to approve your for a financial loan? Let’s learn.

The three C’s

Pursuing the a lot more than data (and maybe a few anybody else) are gained, an enthusiastic underwriter gets down seriously to team. They take a look at borrowing from the bank and fee background, earnings and you may possessions designed for a down-payment and identify their findings as Three C’s: Skill, Borrowing from the bank and you may Guarantee.

Their underwriter look at the capacity to repay financing by the evaluating the month-to-month gross income up against their complete month-to-month repeated expenses. That may trigger a numerical profile called the loans-to-earnings (DTI) ratio. They’re going to along with be the cause of possessions like your bank comments, 401(k) and you will https://paydayloanalabama.com/semmes/ IRA account.

Here, the latest underwriter is trying to make sure you can pay for to pay for future mortgage payments at the top of most recent loans. On the other hand, they wish to find out if you’ve got sufficient drinking water bucks available and also make an advance payment. Otherwise, you are required to spend monthly personal home loan insurance coverage (PMI) near the top of concept and you may attract.

Underwriters evaluate a combined credit report regarding the about three national credit bureaus – Equifax, Experian and you can Trans-Relationship – observe just how you managed repaying loans in the past. During this stage, they will certainly score a become based on how far credit you have taken toward, just what terms and conditions was indeed and in the event the earlier in the day credit history introduces people warning flag about how exactly it is possible to perform repaying the mortgage.

This suggestions can assist this new underwriter determine which style of mortgage is the best for your particular state, what your interest rate will likely be or if you is actually refused, as to the reasons. For those who have not learned right now, that have a great credit history has become the most important basis obtaining a beneficial financial conditions.

Here, your lender wants to hedge their wagers just in case you default towards mortgage. To take action, they purchase a home appraisal to verify the brand new house’s value, besides the amount of the borrowed funds, and then determine a loan-to-really worth ratio (LTV).

If you are searching to get a special home, the fresh new LTV proportion are determined of the breaking up extent of the sometimes the purchase price or even the appraised worth, whatever is gloomier. LTVs come into play while considering refinancing a great financial or you intend to borrow against this new guarantee you will be building of your home. Keep in mind that not totally all LTVs are exactly the same: different types of mortgage loans has various other LTV conditions.

Query family and friends just how long they took to enable them to obtain underwriting approval. Particular loan providers may take between 3 days so you’re able to each week to track down back to you. Often significantly more.

During the Way, all of our mission is to try to keeps underwriting complete initial within the very little as half dozen days* from searching the application. Provided, this schedule are going to be affected by a couple of things: how fast you turn-in all documentation, vacations and the period your submit your application.

If you are a potential homebuyer with a question in the underwriting approvals and other components of the borrowed funds techniques, reach out to one of the local financing officials to discuss your options. Or, if you find yourself happy to start-off now, you can always incorporate online!

*Even though it is Direction Mortgage’s objective to provide underwriting results contained in this six era regarding receiving a credit card applicatoin, process financing inside one week, and you will close-in one day, extenuating items could potentially cause waits beyond this windows.

Mitch Mitchell was a self-employed factor so you can Movement’s profit agencies. The guy and writes from the technical, online shelter, the new electronic degree society, traveling, and you can living with animals. He would like to live someplace warm.