For many who very own your residence, you happen to be responsible for maintaining the standing, might place a strain on your own handbag. This is exactly why very it is strongly recommended remaining 1% of one’s residence’s worth otherwise $step one for every single sq ft within the a family savings to greatly help security fixes. Homeowners insurance just covers specific danger, if you split your sink or your homes roof should become changed because of decades, you could be toward hook up for the costs. And you will domestic solutions will likely be pricey. For the 2020, the average family spent $3,192 towards the home restoration costs and you can $1,640 to possess crisis systems, predicated on HomeAdvisor.

You might be in a position to cover small repairs from the crisis savings, exactly what if you need to replace your furnace or resolve your own foundation (that may for each costs thousands of dollars)? If you aren’t sure how-to buy a required household resolve, borrowing money might be a choice.

What exactly are household fix loans?

When you need let investment an expensive remedy for your residence, you may use a home fix financing, which is an enthusiastic umbrella title for your type of mortgage utilized to pay for house fixes. Each kind of family repair mortgage has its pros and you can disadvantages, and lots of are easier to be eligible for as opposed to others. The possibility that’s effectively for you may also trust personal items, just like your credit rating therefore the amount you will want to obtain.

Personal loans

Depending on the financial, you can borrow anywhere from $step one,one hundred thousand to $fifty,000 or maybe more, and since the money can be used for any mission, you’ll have independency with the manner in which you invest they. This is exactly of use if you need to combine specific obligations at the same time you pay for your house resolve, eg. Additional big advantage of signature loans is the fact that financing are approved rapidly, constantly inside a matter of weeks.

Extremely unsecured loans was unsecured, definition they don’t want security, however it is possible to get an unsecured loan secured by your car. These are often called vehicle security loans and regularly include all the way down rates of interest than unsecured unsecured loans, especially if you keeps reasonable borrowing. As with most finance, the lowest pricing try reserved for creditworthy borrowers, but it is and you’ll be able to to find a zero-credit-look at consumer loan, referred to as an installment loan. This type of feature much higher cost, but on one makes it possible to generate borrowing so you will have top credit alternatives afterwards.

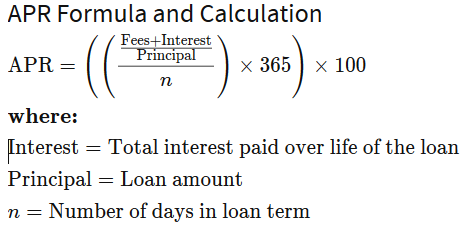

Extremely lenders keeps an excellent prequalification process that allows you to see your rate as opposed to damaging the borrowing, to compare alternatives away from various other loan providers. Definitely pay attention to the origination fee, and is taken off the cash obtain, additionally the Apr, hence stands for the total price of borrowing from the bank. When you can, stop signature loans with prepayment punishment.

Family guarantee financing

A property collateral loan was a means to faucet the fresh collateral you may have in your home. Basically, you are credit straight back a percentage (constantly as much as 85%) out of what you currently paid-in through your home loan repayments. Just as in a personal loan, you are getting a lump sum payment that have repaired rates, and words generally speaking last four to 15 years. While making use of the currency and then make an important improvement, for example substitution your own Heating and cooling system, in the place of a frequent fix, the eye is usually taxation-allowable.

The fresh disadvantage is that you can easily shell out settlement costs as if you performed together with your financial, and they is run up to help you 5% of prominent. Their rate of interest will also most likely americash loans Bell getting higher than the first mortgage. And because a property guarantee loan are secured by your household, for individuals who feel struggling to maintain the financing repayments, you risk foreclosures.