29 Vanderhei’s (2014) simulation show in addition to showed that senior years balances is significantly enhanced in the event that package loan defaults was considerably shorter or eliminated.

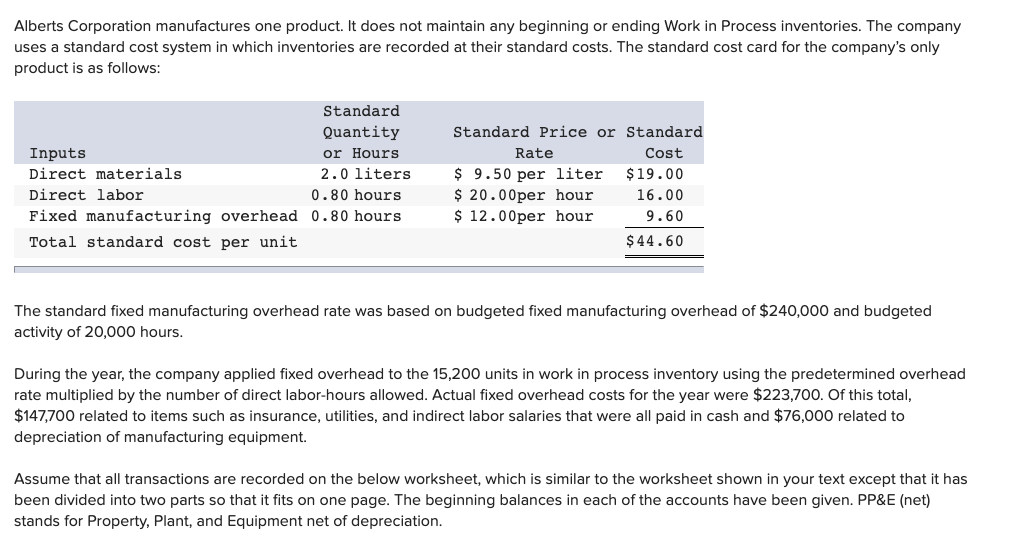

Table cuatro

For the contribution, defaults are widespread one particular making work with that loan, but pair manage details features financially meaningful outcomes towards the imply standard rates out-of 86 %, other than the total mortgage equilibrium. Appropriately, almost every other unobserved items was driving retirement financing non-payments, like monetary illiteracy, high staff discount rates, otherwise decreased notice-manage. twenty-six This may signify people credit from their later years preparations have been merely unaware of the effects away from jobs termination to possess their 401(k) money, very in their mind, mortgage defaulting was accidental and unanticipated.

To help you show exactly what a change so it meaning tends to make, we discover you to merely eight percent of your own mortgage non-payments observed inside our dataset was in fact deemed loan distributions. The rest ninety five % resulted of defaults into occupations cancellation, which are the appeal best personal loan lenders with no origination fee of your expose data. Accordingly, research toward considered withdrawals seriously understate the fresh new yearly worth of old age package loan non-payments. Implementing our very own decide to try portions into entire personal 401(k) program demonstrates that aggregate system-wide loan defaults total approximately $5 million a year, or higher seven times new $600 billion in deemed loan withdrawals. 28 This is not a little contribution, yet it is much lower as compared to $74 billion away from account bucks-outs into the employment termination (inside the 2006; GAO 2009). Assuming a beneficial income tax speed regarding 10% and factoring in the ten percent penalty of very early withdrawals, we imagine the tax revenue streaming to the You.S. Bodies with the defaulted DC plan fund to go on new order out-of $step 1 mil a year.

These types of conclusions emphasize the reality that DC membership would render of several pros having pre-old age exchangeability in order to meet newest practices means, whilst plans was indeed designed mostly to take care of old-age financial cover.

Outlined detailed statistics by the loan policy can be found in On the web Appendix Dining table step 1

4 In total, doing 90 percent out of bundle users got access to bundle funds, and something-5th away from productive experts had a good funds (in 2011; Vanderhei, Holden, Alonso, and Bass, 2012).

17 The content was provided by number-keeper Leading edge not as much as minimal availability conditions, therefore the identities off private businesses and you may participants had been disguised. The fellow member properties are very the same as people said about EBRI/ICI Fellow member Studies Collection Endeavor (ICI 2009; Vanderhei ainsi que al. 2014) to have DC plan users within their take to. Our imply account balances is actually 23 per cent high and you will mean amounts borrowed up to 20% huge; for further comments come across On the internet Appendix Dining table 2. Whenever we enterprise all of our results nationwide, like in our very own income tax impression rates, we build relevant alterations. See the taxation talk for much more information.

twenty-eight During the our very own five-year several months, we come across regarding 130,000 mortgage defaults having an aggregate annual defaulted financing balance off around $0.156 million. In the 2006 there had been 58.cuatro million energetic 401(k) people (All of us DOL, 2013), and and in case 90 percent had the means to access package money, this means you to on 52.5 billion workers had been permitted get 401(k) fund you to definitely 12 months. Extrapolating from our 1.step three million people take to will bring a quotation regarding $six.step 3 mil having full 401(k) annual non-payments. I next lose it figure from the 20 percent so you can $5 mil, reflecting the better mortgage values in our sample in accordance with new EBRI-ICI decide to try. As an alternative, when we were to have fun with a matter away from 65.8 mil participants for everybody private DC arrangements, this should increase the imagine so you’re able to $5.8 billion, though it is actually undecided whether or not plan borrowing from the bank in low-401(k) arrangements is just as highest such as 401(k) arrangements.