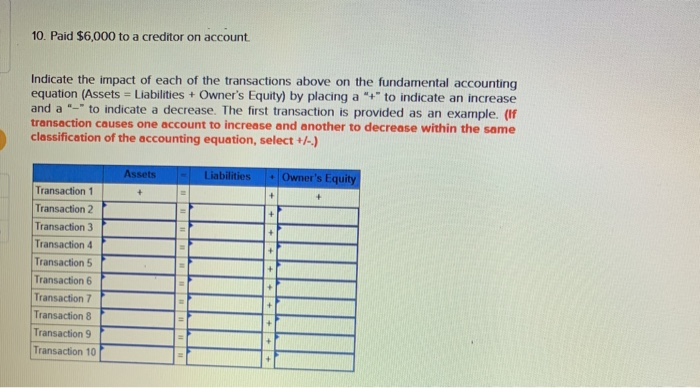

Whenever you are like other almost every other People in the us in debt who own a household, you might have been curious about, was a home security financing a good idea to own debt consolidation reduction? Unsecured debt is actually approaching $14 trillion in the usa, with more than $800 billion in a fantastic credit debt. A good way people are deciding to address brand new higher-notice debt they have been stuck that have is through household equity funds. Domestic guarantee loans are going to be an approach to combine the debt while having on the road to to-be financial obligation totally free. Due to the fact risks of the them are large, the attention pricing and you may monthly obligations usually are below just what you normally spend together with other forms of debt, making them an incredibly glamorous alternative.

What exactly is A property Collateral Mortgage?

Property equity mortgage try a loan issued based upon the newest worth of the equity of your property, and it spends our home while the security toward obligations. Thanks to this, home equity financing are often referred to as secured finance. There’s two very first sort of household guarantee financing: a fundamental lump sum, and you can a home collateral personal line of credit, otherwise HELOC, which gives your a great pre-accepted borrowing limit which enables you to select how much cash you borrow secured on the brand new equity you really have in your home. Of several lenders give both of these type of financing so you can users in an effort to combine their an excellent costs.

*Before you make one behavior concerning your tax returns, always talk about their qualifications to deduct notice in your family equity financing or household collateral personal line of credit (HELOC) with an income tax elite.

The benefits of House Collateral Money

As you ponder whether a house guarantee loan is a great suggestion so you’re able to consolidate your debts, it is important to have a look at the lots of benefits. One of the primary gurus these financing bring in accordance with fundamental debt consolidation reduction loans would be the fact, because they’re safeguarded toward guarantee in your home, most lenders give them at down interest rates than many other brands off funds. A lowered rate of interest form your own monthly mortgage costs is down. Occasionally, because of higher amounts of a fantastic personal debt and you may/otherwise the lowest credit history, providing a protected financing such as for example a great HELOC or household guarantee loan are a borrower’s sole option for debt consolidating. Fundamentally, consumers will often be capable deduct the interest off their home equity money whenever filing the taxes, also.

The fresh Disadvantages regarding Home Equity Financing

If you’re there are lots of terrific positive points to playing with a home collateral financing to have debt consolidation reduction, there are even specific downsides to those type of fund in order to thought. The greatest downside to home equity fund and you can HELOCs ‘s the total chance. As opposed to having a fundamental unsecured debt consolidation loan, if you can’t remain settling your residence security mortgage, you could potentially exposure foreclosures and beat your home. On the other hand, when the home prices in your area lose considerably, you could end up due a substantial personal debt. So, as you think in the event the a home guarantee financing is a good idea getting debt consolidation, make sure you’re very positive about what you can do to invest the fresh new financing back your happy to put your household towards range.

Making sure House Guarantee Is a great Complement

Another thing to consider before choosing in order Blountsville loan places to combine your debt that have a house collateral financing is whether or not a loan can let you address your debt circumstances. For people who depend heavily upon mastercard and you will revolving personal debt due to suit your personal paying designs, including, following consolidating your debt would not do anything to handle the root causes you to definitely had your towards the personal debt first off. Also, if your personal debt products enjoys recently be much more serious due to a cut-in period otherwise spend at your workplace, otherwise work losses, upcoming taking right out additional obligations having a home guarantee financing may set you inside the a more precarious financial position.

If this is happening, other strategy, for instance the credit card debt relief, is generally a far greater choice for you. While completely not knowing how exactly to move ahead and target your an excellent costs, conversing with an obligations therapist or other leading monetary mentor is a fantastic way to determine if a property equity mortgage is an excellent fit for your own personal financial predicament.

Therefore, was property equity loan sensible getting debt consolidating? Positively! However, before you decide to take-out property collateral financing, correspond with a reliable economic mentor first. An excellent coach can assess your existing financial predicament to discover how to explore property collateral mortgage to work with your expenses, so you can get on the path to getting loans totally free forever.

National Debt relief

National Debt relief is just one of the premier and best-ranked debt relief people in the united kingdom. Including delivering expert, 5-star functions to the website subscribers, i together with run educating users round the The united states on how to top would their cash. Our postings coverage information doing individual loans, rescuing resources, and more. We have offered many customers, settled more $1 billion for the consumer debt, and you can our attributes have been looked into the web sites such as NerdWallet, Mashable, HuffPost, and you will Style.