Also it can become just as tricky should this be the second day. Recycling Virtual assistant entitlements comes with tons of questions regarding financing limitations, how much entitlement you have kept, and more.

After that, your determine just how much you have according to the county’s financing restrict and you may circulate to the purchasing the possessions you constantly wanted.

Exactly what are Very first and you may Tier 2 Virtual assistant Entitlements?

This gives your own bank believe so they are able provide the Va Financing with no downpayments and you will zero PMI. And it also brings a separate chance to do have more than simply 1 Virtual assistant Mortgage immediately.

If you’ve never ever used entitlement prior to and/or Department out-of Pros Facts (VA) enjoys revived the entitlement, you start with what is titled Basic Entitlement. It is $36,000 having lenders around $144,000.

Experts and you will energetic-duty servicemembers qualify for Level 2 Entitlement (also referred to as added bonus entitlement) if you find yourself choosing a home over $144,100. The latest Va guarantees $36,100000 off Basic Entitlement and you can twenty-five% of the county’s mortgage limit.

Together, each other types of entitlement combine as your Complete Entitlement, providing probably the most money possible to buy a home.

Calculating Your Remaining Va Entitlement

Calculating your left Virtual assistant Entitlement you can do yourself otherwise with the help of a skilled financial. Earliest, second Level, and you can leftover entitlement computations will be the most typical we come across having the home buyers we manage.

Earliest Entitlement Formula

You’ll receive $36,100 inside very first entitlement on Virtual assistant if you’re loan amount was under $144,100. Brand new Certificate away from Qualifications (COE) informs if or not you stil carry Very first Entitlement or otherwise not.

We’ve viewed consumers see sexy land for the Tennessee and North carolina for the reason that price range and you can located financing in the eventuality of standard.

2nd Level Entitlement Calculation

With the aid of an effective Virtual assistant lender, you can easily capture twenty five% of the county’s Virtual assistant Mortgage Maximum and discover the quantity of entitlement once you have used the first up.

A common situation we’ve got observed in Arizona are subscribers one flow to help you Maricopa State. Since the financing limitation is actually $647,two hundred, would certainly be entitled to a 2nd Level Entitlement away from $161,800.

Left Entitlement Computation

You’ve got already made use of the $thirty six,000 First Entitlement and you may precisely what the Virtual assistant calls complete entitlement but are interested in various other property.

In these instances, an experienced lender take you step-by-step through a simple formula to calculate the leftover entitlement. It refer back once again to the prior Virtual assistant Mortgage and employ it having discovering the brand new number.

You can also proceed to the fresh Vanderberg Air Force Foot within the Ca on account of good PSC, yet not have entitlement leftover.

Which have utilized all entitlement, the fresh Va do simply take twenty five% of new county’s Va Financing Maximum ($783,150 for the Santa Barbara) and subtract this new entitlement you used of it.

Virtual assistant Lenders do not require a down payment for as long as you sit within the First and you may next Level Entitlement numbers. For many who go beyond, the lending company requests for money down to include its investment.

You can even utilize the Va Financing to buy a home that have an optimum loan amount which is equal to or lower than the rest entitlement.

We believe this is your family’s consider live new American Fantasy and enjoy this excellent Country you’ve sacrificed to possess. By the dealing with a talented Va Bank, they help you get the largest bang for the Virtual assistant entitlement dollars.

Va Mortgage Limit by the State

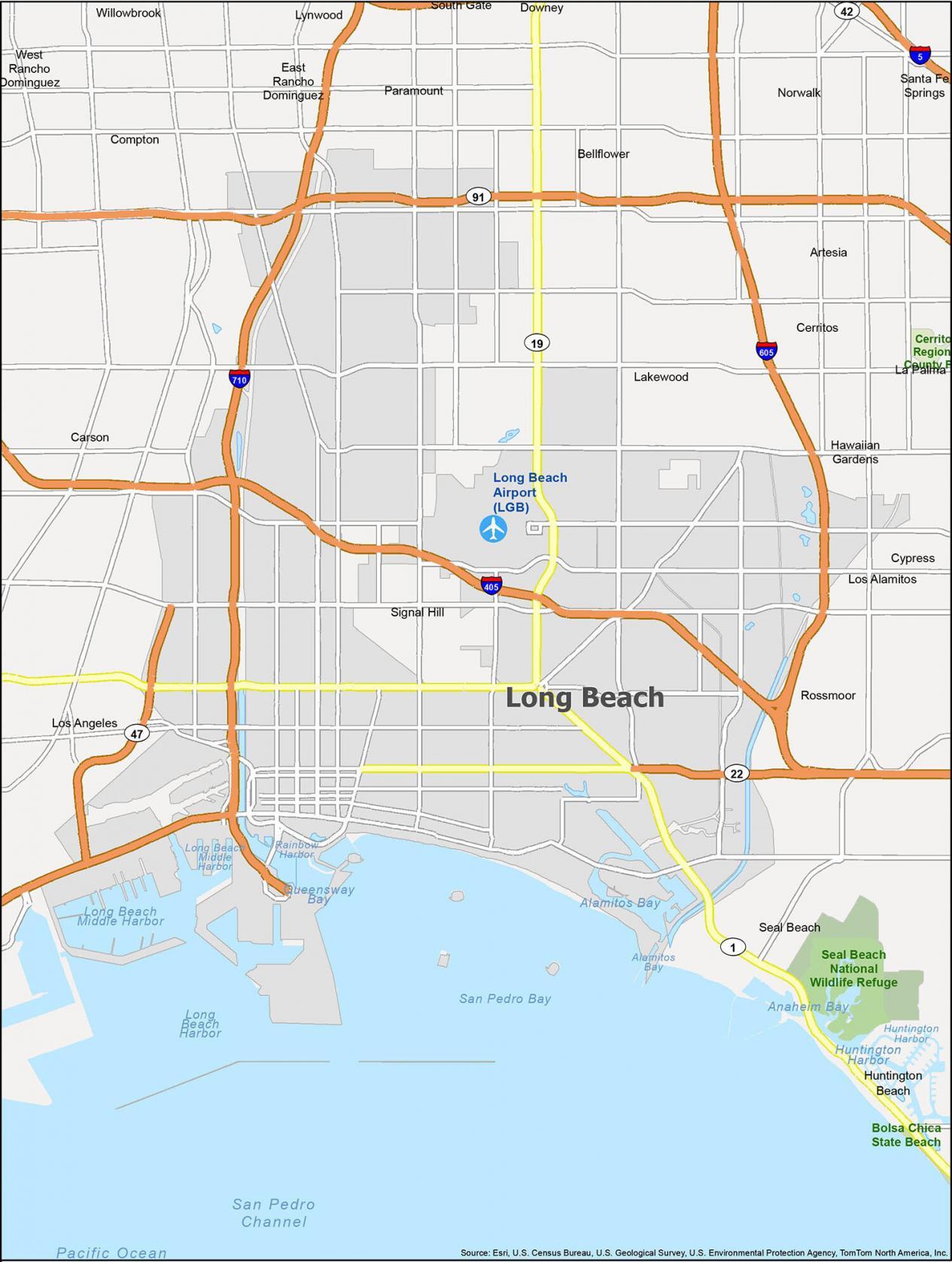

The fresh Virtual assistant is an authorities institution one to understands both you and your companion is generally stationed otherwise retiring in a very expensive area of the nation, such as for instance Ca. It to evolve Va Loan Constraints according to cost-of-living of particular county.

You can purchase your ideal house with trust understanding the Va will give enough. Honoring your armed forces provider, brand new Dept. away from Pros Issues prize your with plenty of bucks to help you reap which have a zero downpayment mortgage.

Take a look at additional conforming loan limitations for every single county. Very loans Plantsville CT says have the basic Va Financing Limitation from $647,2 hundred to make simple to use to determine their second tier entitlement.

Entitlement to possess Earliest-Date otherwise Seasoned Customers

Virtual assistant Entitlement is actually for people energetic-obligation solution user or veteran which is prepared to choose the domestic its family members’ always desired. Its the ultimate for you personally to get property near your own station or even relax near loved ones on your own last household.

I have a team of army-work at lenders you to definitely understand the procedure for to get a first or next house or apartment with new Va Financing. The staff is ready to answr fully your concerns and go you from Va Mortgage Journey action-by-action.

Contact us now from the (480)-569-1363, so we can award you to suit your newest otherwise earlier army services to that Great Nation.