On this page

Once you have registered to have ANZ Web sites Banking (and you can linked your property financing so you’re able to they), you’ll be able to manage your ANZ Home loan no matter where your is twenty-four/eight, if you have internet access.

- Look at your latest financing harmony, interest rate and financing label information

- See the loan fee agenda

- Glance at details regarding your connected ANZ You to offset account (when you have one to)

- Make changes for the current Head Loan Percentage otherwise incorporate a great brand new Lead Financing Percentage for you personally.

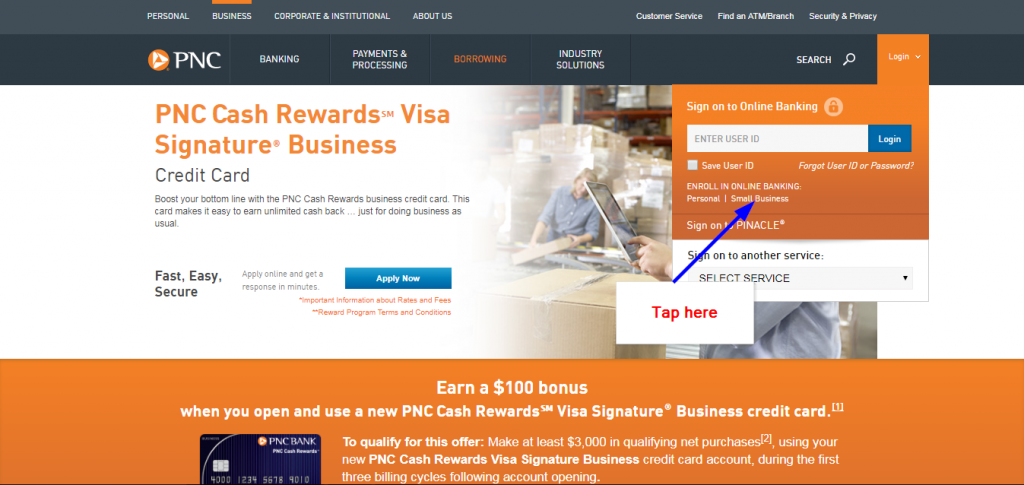

You can use the ANZ Application observe the loan stability, deal history and more. Tap on your membership, the fresh new faucet for the Financial Details observe the interest, repayment matter and you may frequency, and other details throughout the ANZ Application. That is convenient.

What is an evaluation rates?

A rate that will help your workout the actual cost of a loan. That it rate takes most other costs and you can fees into account, such as for instance financing recognition fee and financing administration fees while doing so into the interest. It’s intended to be a beneficial fairer way of researching how much financing costs.

How are my personal interest determined?

Interest is calculated in line with the outstanding day-after-day equilibrium of your own financing. Such as for instance, should you have that loan balance out-of $150,000 plus interest rate are 6% p.good., your attention charge was: $150,000 x 6% divided because of the 365 days = $ regarding go out. For the majority ANZ Lenders, attention can be calculated each and every day and you may charged monthly. To own info consider brand new ANZ Individual Credit Fine print (PDF 412kB) plus letter away from bring.

What takes place whenever rates alter?

When you yourself have a varying rate financial otherwise home-based financing mortgage, rates ount. Mortgage loan go up ount rises, when you find yourself a belong interest rates ount dropping. If you have a fixed speed mortgage, your own minimal monthly necessary fees cannot transform within the fixed months.

How do i shell out my financing off fundamentally?

When you have an ANZ Simple Adjustable Rates mortgage, you will find several different ways you will be in a position to spend your loan out-of sooner or later:

- You could potentially love to improve the amount you pay back otherwise generate an extra lump sum payment.

- If you don’t want to make a lump sum payment otherwise improve payments, then you might contemplate to make repayments for the an excellent fortnightly cashadvanceamerica.net online personal loans foundation in the place of month-to-month. You are able to shell out a bit more temporarily however, lose your own demand for the near future.

- Making use of your ANZ You to definitely counterbalance account disclaimeris one other way to save on the attention payable. Connected with an ANZ Practical Changeable Rate otherwise one-season ANZ Fixed Financial, the bucks you may have in the ANZ You to definitely counterbalance membership often counterbalance the matter you owe on your own financial, and you’ll simply be energized attract into the differences.

Repaired rate finance supply the certainty out-of fixed money and give us certainty regarding appeal we’ll found more than your own fixed rate name. This enables us to make hedging and financing arrangements to complement all of our customers’ financing needs. disclaimer To make these preparations, i happen attract costs. For many who pay off particular or any repaired speed mortgage very early or switch to several other fixed or changeable interest before the end of your own fixed rate name, we’ll need to change all of our capital agreements. Early Cost Costs allows us to get well a fair estimate of the purchase price sustained into the altering those individuals investment plans.

ANZ grabbed a mortgage more my household when i got my home loan. Now that I have paid back my personal financing, will ANZ release its home loan?

But not, you need with the intention that all the financing which have ANZ that is secured by financial might have been repaid. You to lending start around second money you have taken or money to own and therefore you’ve considering a pledge.

To learn more about how to possess a keen ANZ home loan put-out, please consider anz/accept or see your nearby ANZ department.

How do i rating a payment profile to shut my personal domestic loan?

You can see a payment contour for your home financing when you need to close they because of the calling thirteen twenty five 99 ranging from 8.00AM, and you can 8.00PM (AEST) Monday in order to Friday.

You can also request to shut your ANZ financing on the web by the giving a safe send due to ANZ Websites Banking when otherwise when you go to people ANZ part.

For those who pay a predetermined rate mortgage early otherwise switch to other fixed or adjustable interest rate before the avoid of one’s fixed identity, or build very early or even more money, you may have to pay an earlier Fees Prices (that is certainly massive). Consequently, before deciding whether to romantic your house financing (otherwise and work out other alter so you’re able to they), delight see the effects of using this method. For more information on very early installment can cost you, please relate to ANZ Fixed Rate Money – What will happen for folks who pay some or it-all very early? (PDF 47kB).