Mortgage borrowing from the bank licenses (MCCs)

Title more or less says it all. In a few states, the latest property financing service otherwise its comparable things mortgage borrowing from the bank licenses (MCCs) so you’re able to homeowners – specifically earliest-time of those – that permit them spend shorter within the government taxation.

MCCs are granted directly to being qualified homeowners that are then titled when planning on taking a beneficial nonrefundable government tax borrowing from the bank equal to a selected percentage of the eye repaid to their mortgage yearly. These types of taxation loans shall be pulled during the time this new borrowers document their taxation statements. Alternatively, individuals can amend their W-cuatro taxation withholding versions off their company to minimize the quantity regarding government taxation withheld off their paychecks to have the benefit every month.

This basically means, MCCs enables you to pay shorter federal taxation. So you can afford a better, loans Brilliant AL more costly domestic as compared to one you may get without them.

Dream Manufacturers program

As opposed to really DAPs, new Fantasy Firms Home buying Advice system throughout the PenFed Foundation are unlock in order to people with offered productive obligations, set aside, national protect, otherwise seasoned services.

You ought to be also an initial-date consumer, although that is identified as people that have not possessed their own home into the past three years. And you may be considered if you have shed your property in order to an effective emergency otherwise a divorce.

But it assist is not meant for the brand new steeped. Your earnings need to be equal to otherwise less than 80% of median toward area where you are purchasing. However, that’s adjustable with respect to the size of your children. When you provides a spouse otherwise dependents, you can generate way more.

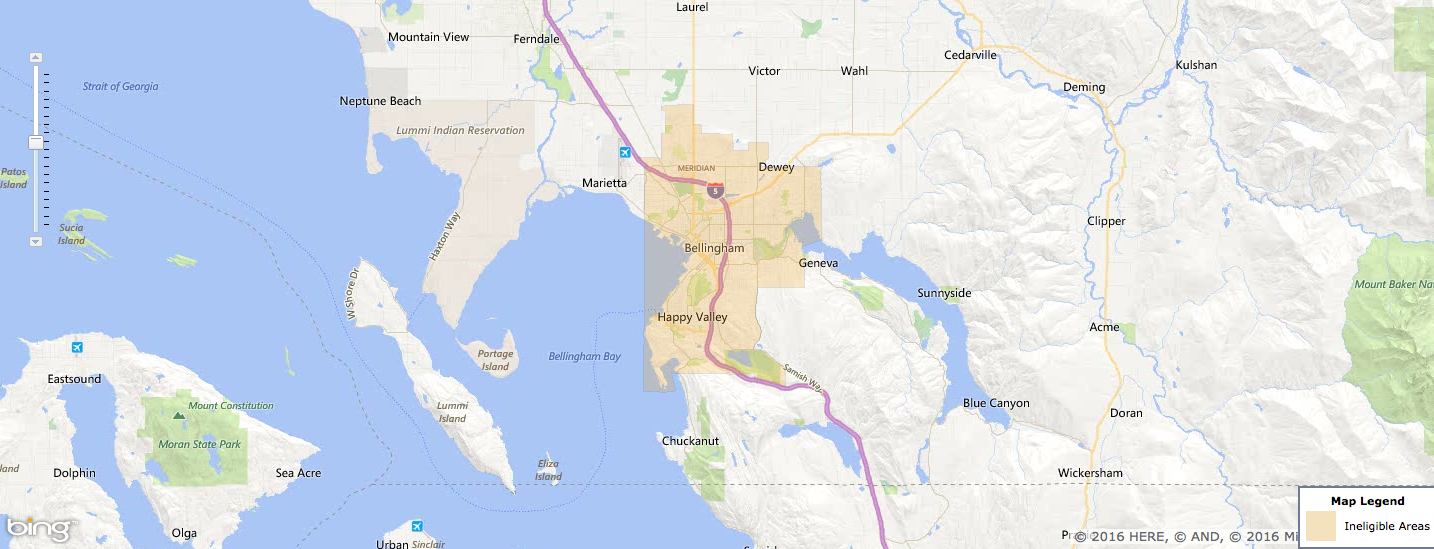

It’s all some time difficult. Making it just as well one PenFed features a lookup unit (into the You Dept. off Housing and you may Urban Innovation (HUD’s) website) one to allows you to select the income limits and you can median household members money for which you want it.

You will need a home loan pre-recognition otherwise pre-degree page out-of a reliable bank to help you just do it. But your stand to discovered money from the origin because follows:

The level of the fresh give relies upon a two-to-1 match of your own borrower’s contribution to their home loan within the serious put and money produced within closing having an optimum grant out of $5,one hundred thousand. This new borrower must contribute at least $five hundred. No money back will likely be received from the debtor during the closing.

Very supposing you really have $dos,100 saved. The origin can add $4,one hundred thousand (2-to-1 meets), providing you with $6,100. In lots of metropolitan areas, which could easily be enough to see you feel a homeowner.

You don’t have to use that cash to own a beneficial Va loan. You could go for a keen FHA otherwise conventional mortgage. But, because of the professionals that come with Va finance, why should your?

New Dream Firms program has become the most greatest ones providing assistance to vets and you may services members. But there are lots of other people, some of which try locally founded.

Including, customers of the latest York is check out one to nation’s House getting Veterans system. That will give doing $fifteen,100 just in case you be considered, regardless of if they’re first-go out people.

I guaranteed to inform you how to find people a large number of DAPs – while the MCC programs that are available a number of states.

It requires a tiny try to find all of the of these you to definitely might possibly make it easier to. you will be able to song them off regarding comfort of your own home, on the internet and over the telephone.

A starting point is the HUD regional homebuying programs lookup tool. Get the state the place you need it up coming get a hold of an excellent connect and look for recommendations apps.