- Interest rates Charged: The pace a loan provider charges for interest otherwise Annual percentage rate is important into terms and conditions of loan. So it rate can certainly twice as much amount borrowed if it is too high.

One of the primary one thing we made sure are the loan providers one manage from the networks needed lower than weren’t charging excessive rates of interest.

However, it is vital to remember that towards the version of financing bad credit get borrowers wanted, it is almost hopeless towards bank in order to charge them an effective low-interest rate. All of our presumption relating to this count is the lender would-be careful and you will understand that its an urgent situation the cash try required for.

This new programs i have recommended less than home lenders that don’t charges exorbitant interest rates. Like that, you compare rates of interest with other lenders in the market; he could be rather comfortable and easy to blow.

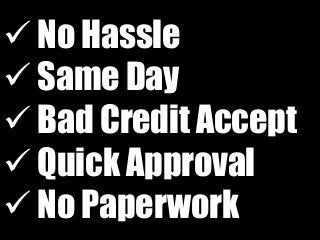

- The latest Files Criteria: This is one of the best you should make sure if you find yourself putting together D labels to highly recommend. Perhaps one of the most issues to notice when you look at the credit a great borrower that have less than perfect credit rating money is which they would not would like you to test its credit history.

This is exactly a consideration that produces this financing high priced and simple. Yet not, specific lenders realize that borrowers having less than perfect credit don’t have a lot of otherwise no method to get help, so that they annoy her or him because of the requesting a lot of data.

The easy application processes is one of well-known advantage of credit money from online loan providers . I guarantee that every single platform i needed below talks firmly on that to their loan providers.

I made sure that every program recommended below provided a software procedure you to definitely failed to get more five minutes to get rid of.

- Short Money Transfer: Is among the 2nd affairs that makes borrowers look for loans regarding on line lenders while in the problems.

In the event the a borrower is always to need to get a loan regarding a good old-fashioned institution like their lender, because of the the period the cash could well be transferred in the membership in time period so you can counterbalance his disaster may have enacted.

However, an internet bank has actually secured your an easy money import so you could offset your emergency without the dilemma.

The labels i’ve recommended lower than hoping its borrowers that they would get the mortgage quantity transferred in their membership contained in this twenty-four days off agreeing so you can small print with the lender.

Q1 The length of time Do A loan application Shot Approve?

- When you’re dealing with the latest programs i’ve recommended, it might just take moments after you’ve agreed to words and requirements for the financial. And amount borrowed decideded upon would-be transferred on your membership in 24 hours or less.

Q2 Exactly what are the Limits Away from Quantity That can easily be Borrowed?

- The internet lender could only dictate the fresh new constraints of the financing amount; the working platform please zero region in choosing the brand new limitations for loan numbers. Pay check lenders is actually every networks that individuals has recommended promote a minimum of $200 and you may a total of $5000.

Several recommended programs work with loan providers to provide your around $ten,000 property value the borrowed funds. According to the situation and style of mortgage versions, a debtor will get doing $40,100 property value the mortgage toward a few of the systems.

Q 3- Was I Committing A crime By applying With no Credit check Funds?

- No, you aren’t. Zero credit assessment fund is court and you will backed by rules. All these platforms one to serve as a market is actually legally joined underneath the called for organizations.