Because the label ways, there is certainly also a federal government ensure attached to the USDA mortgage. However, that have an agricultural field doesn’t have anything to do with your capability to profit from the deal.

In the event the attention from residence is so much more broad-discover room much less metropolitan townhome, a no downpayment USDA loan might possibly be a fit for your.

What is a good USDA mortgage?

The usa Department out of Farming (USDA) mortgage (referred to as the USDA Outlying Homes Invention Protected Homes Program) is an authorities-provided a hundred% financial support program built to boost the economy and you will total well being from inside the rural elements.

By making affordable, low-appeal home loans offered to individuals who you are going to otherwise have a problem with the newest down-payment and borrowing conditions from conventional financing applications, household outside larger locations is qualify for that loan and you can very own the piece of the latest Western dream.

Exactly how USDA funds functions?

Identical to other authorities-backed funds, USDA will not give currency to the new debtor. As an alternative, it verify an element of the mortgage could be fulfilled, even if the borrower defaults.

USDA recognized loan providers utilize the program’s recommendations to share with the underwriting procedure and see in the event that that loan meets the fresh acceptance requirements.

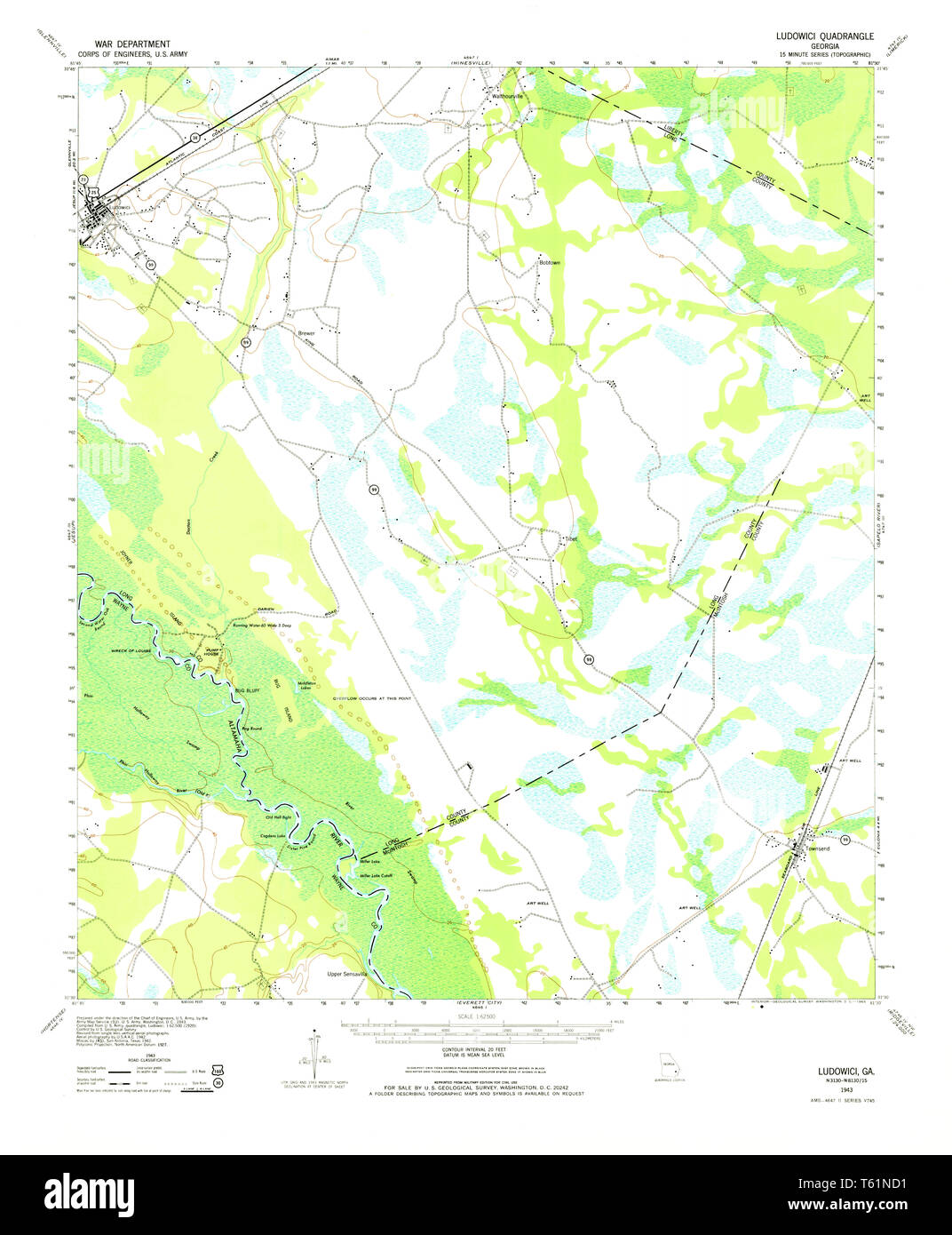

As you can imagine, that loan designed to improve lives inside outlying and you may suburban areas best suits somebody seeking get property in the individuals elements. It’s not only the person who needs to qualify for resource; brand new residence’s location things and ought to get in a location sensed outlying.

It could wonder one see there are lots of home from inside the Ca without a pasture and you can barn you to definitely be eligible for a great USDA financing. The brand new USDA features a qualification page on their site you could use to know if a property sits within an eligible city.

A good many California that lies external town restrictions (even when it’s just exterior) qualifies just like the an excellent USDA qualified town.

Advantages of a USDA loan

- Zero deposit necessary

- Lower financial insurance premiums

- Normally lower interest levels than traditional financing

- Flexible borrowing from the bank criteria

- Did we say zero advance payment and high prices?

After you influence your area possess house that qualify for good USDA mortgage, you’ll want to learn whether you could be considered predicated on their credit score and you can money.

Earnings maximums

Because this is a federal government-recognized system built to bring homeownership within the rural portion, discover money limitations to ensure people do not make use of the application form.

Money constraints will vary significantly from the city and you can nearest and dearest dimensions. You will see a listing of earnings limits for USDA loans in your area here .

Debt-to-money proportion

To be eligible for installment loan Long Beach a beneficial USDA financing, their complete debt-to-earnings proportion have to be no more than 41%. That is to say the debt should not equal over 41% of your month-to-month income. That have proper credit rating and other compensating affairs, the fresh new USDA do generate exceptions doing forty two% yet not one large.

Adequate monthly money

If for example the month-to-month home money is actually $4,000, the brand new proposed mortgage payment, and additionally taxes and you may insurance, will have to become just about $1,160 a month to keep according to the 30% endurance.

Like with the debt so you’re able to earnings ratio, the brand new property proportion can also be, that have good borrowing or any other compensating facts, become risen to thirty-two%.

A job records

Money need to be affirmed as well as have at the very least 24 months away from history in the same business or at the same business. Some conditions can be made to own openings within the a job on account of maternity leave, carried on education on the field, or medical factors.

Credit rating – 620 to 640 lowest

Credit scores must be no less than 640. Applicants with a median credit score anywhere between 620 and you can 6lined operating, and certainly will most likely get a hold of alot more files and stricter underwriting conditions.

Credit history

USDA underwriters want a good credit score records without collections profile delivered to selections over the last seasons. But not, if the there had been extenuating affairs, exceptions can be produced. Plus, too little credit history might be beat having fun with non-conventional revealing measures, eg lease percentage history and you will bills.

Construction situation

USDA home loans commonly accessible to those who already individual a property within this commuting range (identified as a greatly highest urban area) of its need buy city. Such as for instance, you simply can’t individual property inside Sacramento, ca and make use of a great USDA mortgage to buy into the Colfax.

How exactly to sign up for good USDA loan

The financial coach is a fantastic starting place if you imagine good USDA financing would be a good fit for your requirements. After you dictate the property is found for the designated city therefore meet up with the standard criteria, you can fill out an application and stay one step closer to buying a little bit of the brand new country.